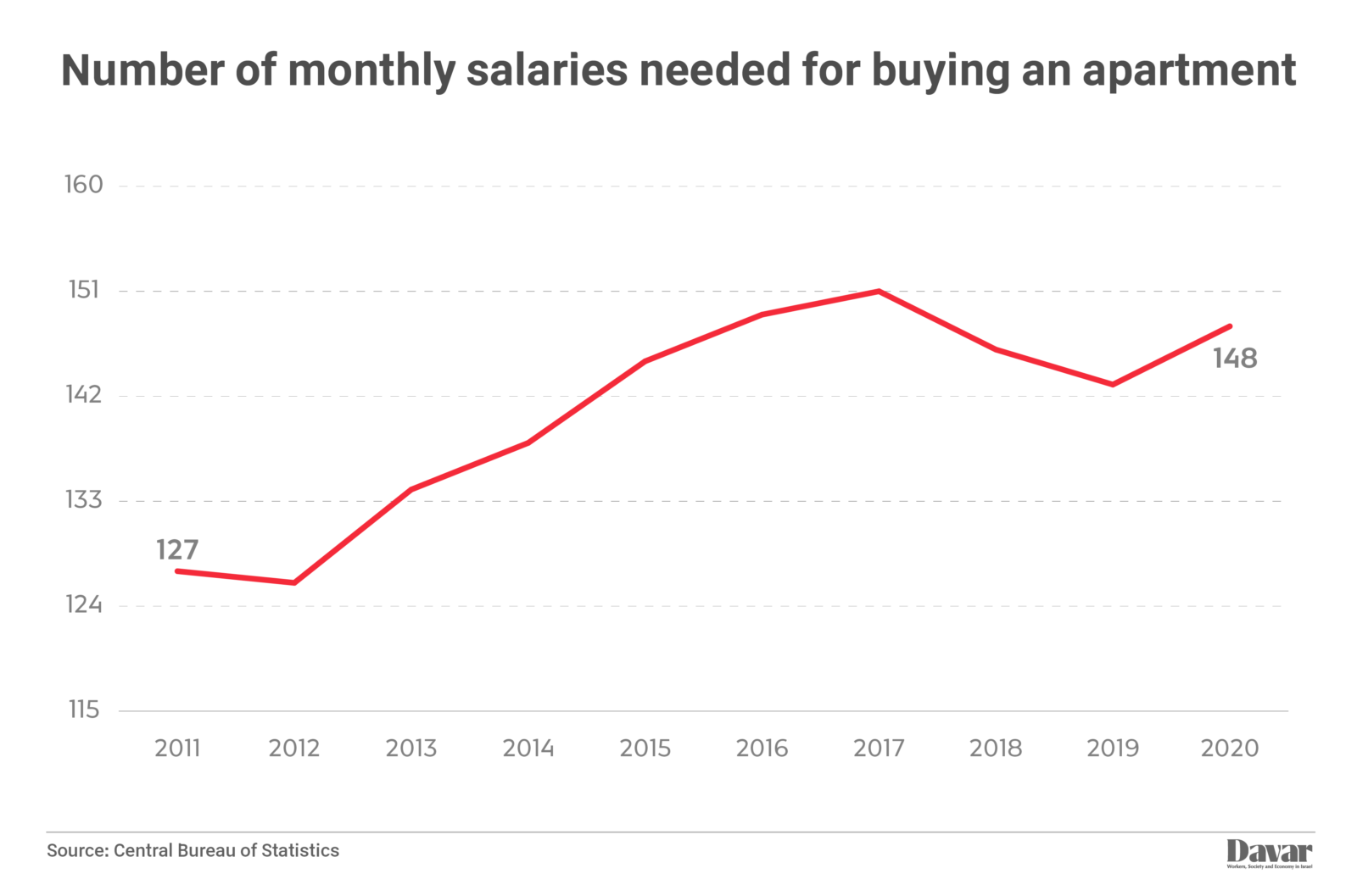

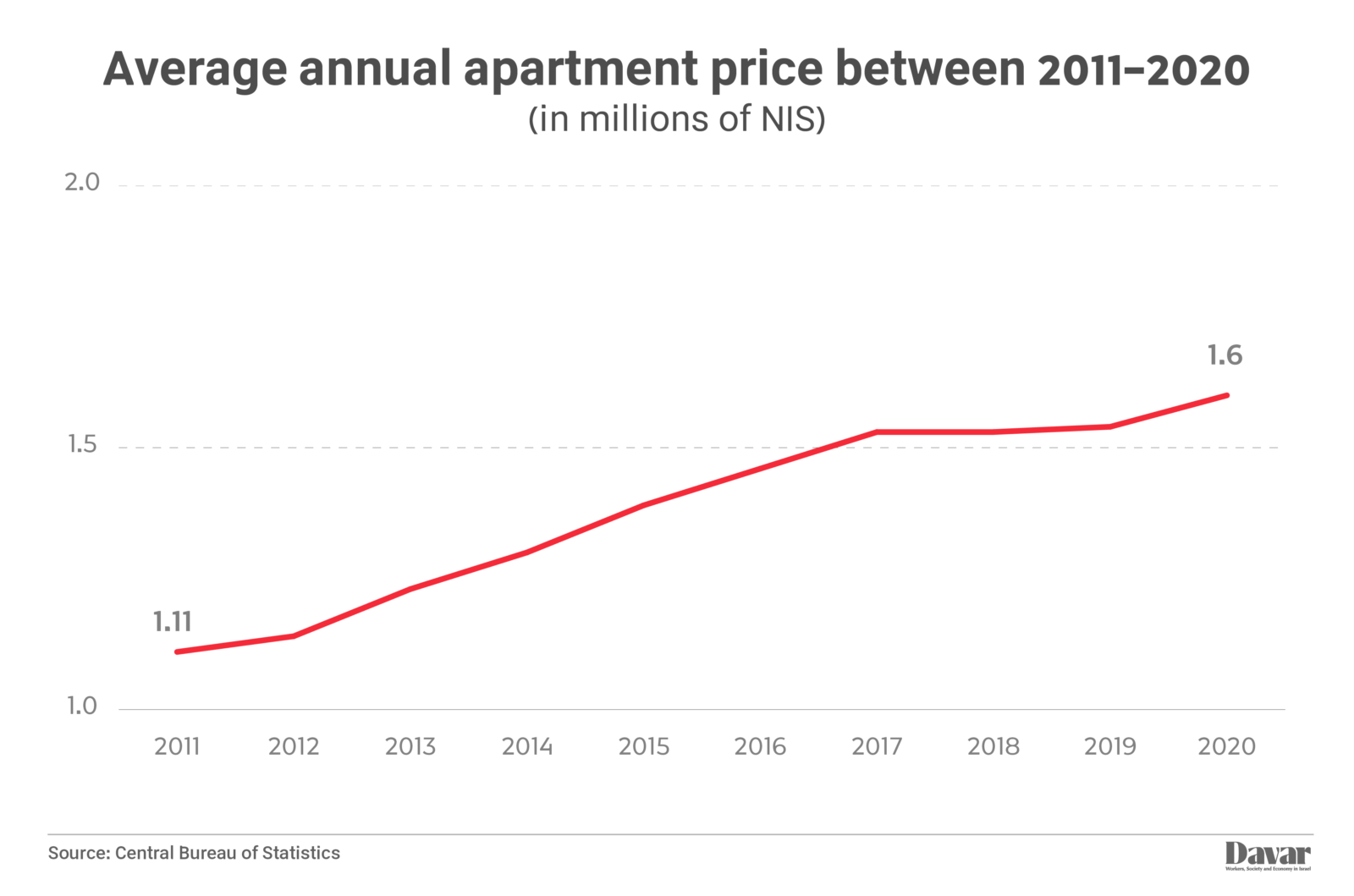

Ten years have passed since the 2011 social protests swept the country by storm, and since then the government has proposed numerous plans to tackle housing prices, all to no avail. In fact, the number of monthly salaries needed to purchase an apartment in Israel has only risen, “only” 127 months’ worth of salary in 2011 to about 148 months’ worth in 2020. At the same time, the amount of public housing available has shrunk, while rent plans have failed to adequately help renters.

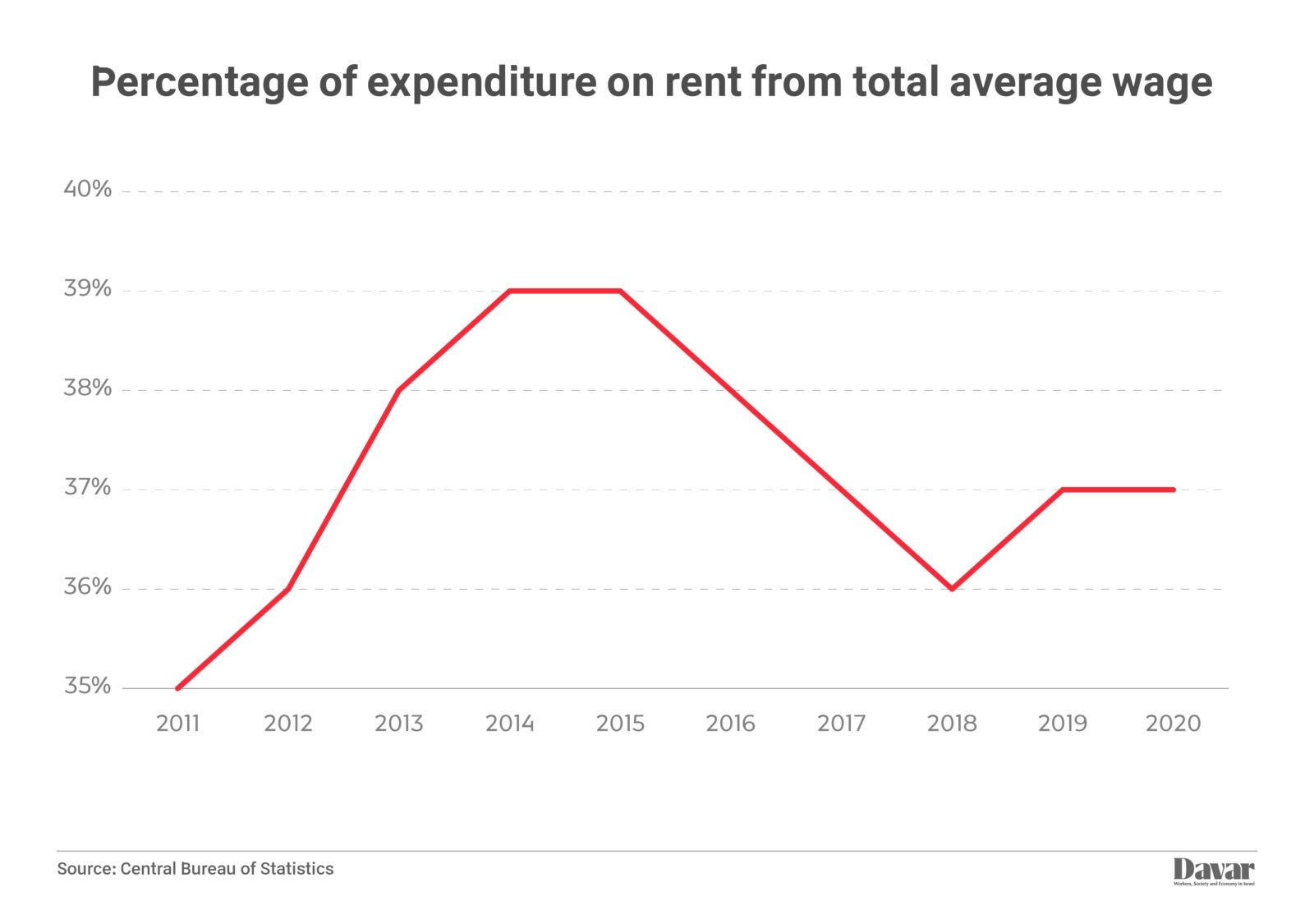

The average monthly rent in 2020 in Israel stood at roughly NIS 4,000. That figure takes up 37% of an individual’s average salary, a two percent increase since 2011.

One commonality exists across the four governing coalitions that tried to address the rising prices in the housing market: the choice not to actively intervene in in the market itself. New laws succeeded in expanding home construction at the expense of long-term planning, by circumventing bureaucracy, but this did not bring about substantial results. Government programs have failed to create a substantial amount of apartments available for renters and the Ministry of Housing added only 1,000 apartments to public housing, while detracting more than 2,000 homes.

At the time of the protests, then-Finance Minister Yuval Steinitz and former prime minister Benjamin Netanyahu blamed the housing crisis on the shortage of housing itself. Subsequent attempts were made in government planning committees to pin blame on the municipalities, and Netanyahu even tried to promote his attempts to privatize Israel's public lands. After Steinitz came Finance Minister Yair Lapid and his flagship housing plan to eliminate value-added tax (VAT) for first-time apartment buyers. This plan did not pan out, along with his promises to build 150,000 housing units for rent.

The only real attempt at significantly addressing the rising housing prices were made by former finance minister Moshe Kahlon and his “Price for New Residents” program. Despite heavy criticism, the data shows that Kahlon’s plan managed to slow down the rise of apartment prices which in turn helped reduce the gap between prices and salary. During Kahlon’s tenure, the state was quite involved in the housing market, but mainly in the form of tax benefits, which led to the transfer of several billion shekels from the state coffers to contractors.

Alongside these successes, there was also widespread criticism of Kahlon’s plans. He led the National Committee for Planning and Construction of Preferred Housing Sites that pushed through local planning. Kahlon also requested to lower the share of investors in the market, both by levying sales tax to investors and through a law meant to increase taxes on those who own three or more apartments. This Plan did not come to fruition.

At the beginning of the coronavirus pandemic the Ministry of Housing was only partially staffed by then-minister Ya’akov Litzman. Former finance minister Israel Katz did not touch the housing matter at all, save for re-lowering the purchase tax rates, which led to the return of investors to the economy. Despite the economic crisis stemming from the pandemic, housing prices began rising again.

Although the new government has placed the housing issue back on the agenda, it has yet to present a comprehensive plan, beyond several shorter term plans that will take time to materialize.