The Bennett-Lapid government is increasing the indirect tax burden on the more vulnerable sectors of Israeli society, even though this tax is already one of the highest amongst developed countries according to a report published last Tuesday by Israel’s Treasury. In addition, as part of the plan to combat the rising cost of living, the government is granting benefits to the more well-off half of the population. All this while the deficit reaches an historic low and state revenues from taxes are rising.

***

The indirect tax in Israel (a tax levied on the purchase of goods and services) is one of the highest in the OECD countries. An indirect tax is not dependent on the level of one’s salary, applying to the rich and the poor equally. Indirect taxes, such as a value-added tax and excise duties, are a heavier burden on the lower classes, eating into a large part of their wages. In Israel’s poorest decile of the population, 37% of their salary goes to the payment of these indirect taxes, compared to only 8% from Israel’s wealthiest decile.

The current government has added indirect taxes on food, fuel, and cigarettes, as well as taxes on sugary drinks and disposable utensils – all of which will mainly affect poorer families, eating into a larger part of their wages or pensions.

The tax on disposable utensils will cost 278 shekels ($85) per year for a family in the bottom quintile (the fifth of the population with the lowest household annual income), compared with 177 shekels ($54) per family in the top quintile, according to the Knesset Information and Research Center. The tax on sugary drinks will cost 191 shekels ($59) per year for families in the bottom quintile, compared with 99 shekels ($31) for the top.

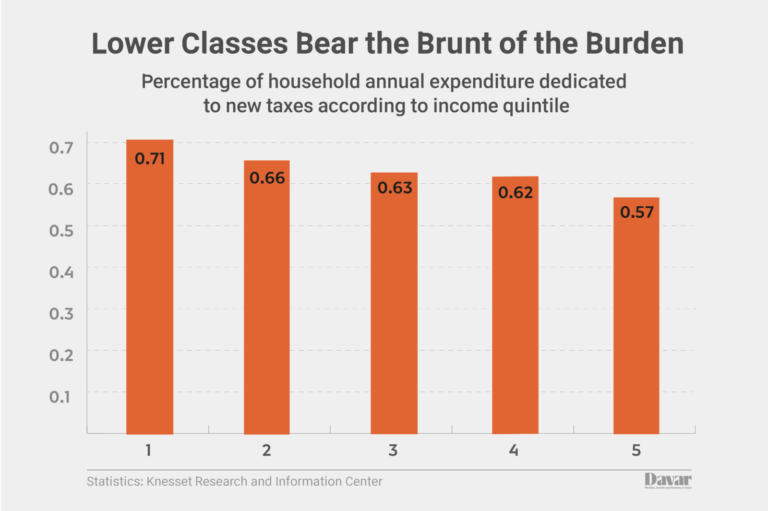

The new taxes will add to the bottom quintile a burden of 0.71% of the total expenses it already bears. On the other hand, a burden of 0.57% of the total expenses currently incurred will be added to the top quintile. The congestion tax on cars entering the Tel Aviv metropolitan area (Gush Dan) during rush hour is also expected to exacerbate this, as lower earning people tend to commute to the expensive Tel Aviv area.

The government explained that the taxes levied on sugary drinks and disposable utensils are in order to take care of the health and future of the planet, but such a move should have been accompanied by lowering other indirect taxes, so as not to burden further burden only the lower classes with the need for state revenue growth. The bottom line is clear: these are economic measures that expand inequality.

***

Another figure uncovered in the finance report is that about half of the public does not pay income tax at all. The salaries of half of working Israelis do not reach the minimum tax threshold. These are workers who do pay taxes, including social security contributions, health tax and indirect taxes – just not income tax. This figure is particularly significant in the context of the new “Combat the Rising Cost of Living” program promoted by the government.

At the center of the program is the addition of credit points to families with children aged 6-12, which increase their income by 223 shekels ($68) per month. The benefit will be given only to those who pay income tax – thus, the more established half of the population. This means that more than 2,500 shekels a year will be distributed to the top quintile in Israel. Another step towards widening the gap.

***

Another statistic that stands out from data published by the Treasury and was verified by data relating to Israel’s deficit – which has dropped to a historic low of only 2.2% – is Israel’s efficient tax collection. In 2021, state tax revenues jumped by 2% of GDP, about 27 billion shekels.

However, the Ministry of Finance is convinced that this is a volatile income, which stems from heightened activity in the real estate and hi-tech industries. Nonetheless, even if this is true, at least some of the activity in hi-tech reflects a steady rise in wages, so that state tax revenues are going to rise even more.

The continuing increase in state revenues from taxes and the reduction of the deficit allow for historical corrections of Israel’s system of services: to expand free education for ages 0-3, investment in the education and health systems, restore existing public housing, and more.

Good universal services are the safest way to ensure Israel can reduce economic gaps and raise living standards. Meanwhile the government is doing the opposite, and continues to shift money from the pockets of the poor to the pockets of the rich.

This article was translated from Hebrew by Jonathan Epstein.